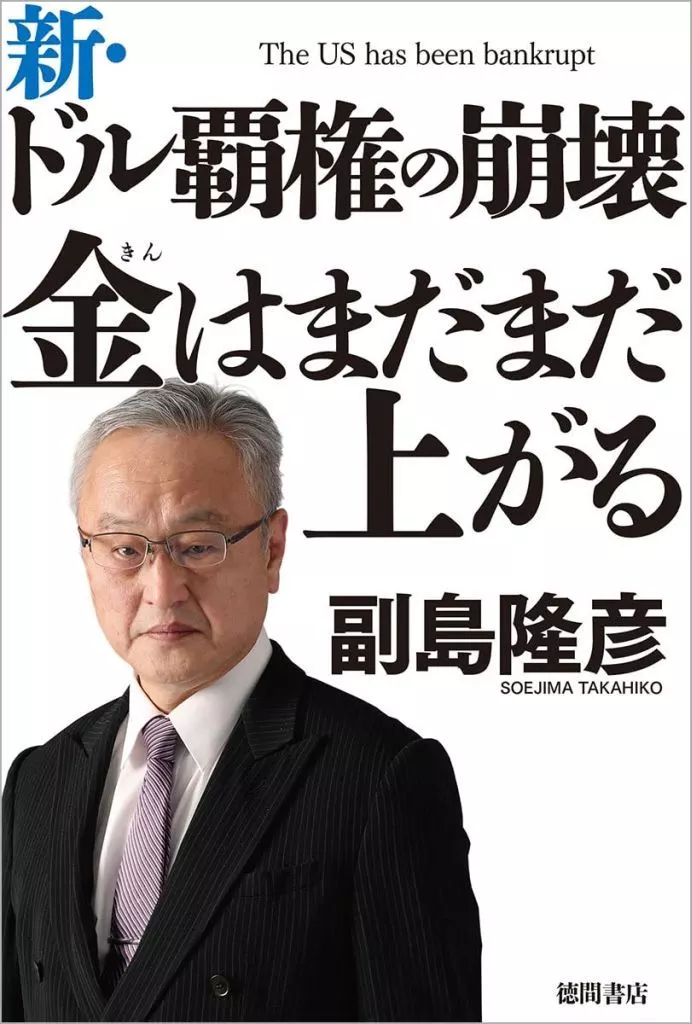

Economy The Collapse of Hegemony of the New Dollar : Gold Still Rising / Takahiko Soejima

Product description ※Please note that product information is not in full comprehensive meaning because of the machine translation.

ECONOMY

President Trump's Tariff War has begun. But as soon as the high tariff policy was announced, an unexpected ambush appeared. The Japanese Government of Agriculture, Forestry and Fisheries was the trigger. The Japanese Government of Agriculture, Forestry and Fisheries was the one who pulled the trigger. The Japanese Government of Agriculture, Forestry and Fisheries was the one who pulled the trigger. The Japanese Government of Agriculture, Forestry and Fisheries was the one who pulled the trigger. The Japanese Government of Agriculture, Forestry and Fisheries was the one who had suffered huge losses from investing in Japanese government bonds. The ベッセント Treasury Secretary rushed into President Trump's office and said, "Stop shooting!". President Trump announced a 90-day suspension of tariffs. By the way, the triple devaluation of the Government of Bonds, the Dollar, and the Stock Market was avoided. But at this moment, President Trump was defeated. Why did President Trump go crazy and go into the tariff war? If he doesn't eliminate the huge accumulated deficit, the United States will go bankrupt. No, the country is already in bankruptcy. Now that the high tariff policy can no longer be expected, President Trump has no choice but to devalue the key currency of the dollar. Nixon shock, the Plaza Accord again. The dollar will depreciate. If that happens, gold will rise. The author's prediction of the collapse of the US Dollar hegemony will come true. Therefore, we should throw the dollar out and hold the gold.