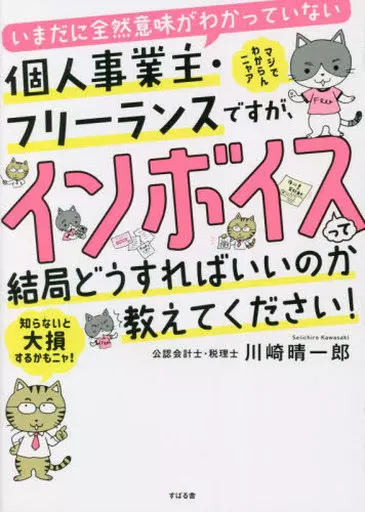

Book (Practical) Economy I am a self-employed freelancer who still don't understand the meaning at all, but please tell me what to do with the invoice after all!

Product description ※Please note that product information is not in full comprehensive meaning because of the machine translation.

Economics

From October 1, 2023, the invoice system will be introduced as a "new system for processing and payment of consumption tax". It is an important system that not only corporations but also sole proprietors and freelancers must be aware of in order to protect their businesses. However, this system is also a serious system for sole proprietors and freelancers with an annual income of 10 million yen or less. This is because tax-exempt businesses will have to choose between paying consumption tax on purchases, outsourcing, outsourcing, etc. by themselves or reviewing business partners when they deal with tax-exempt businesses with an annual income of 10 million yen or less. Tax-exempt businesses with an annual income of 10 million yen or less will be subject to more restrictions than tax-exempt businesses, and may lose their jobs. In order to avoid such a situation, this book explains the complicated invoice system in an easy-to-understand manner with illustrations and two page spread of sentences, and teaches preparation and measures for sole proprietors and freelancers.